Has the US ever had no debt?

1837: Andrew Jackson

As a result, the U.S. actually did become debt free, for the first and only time, at the beginning of 1835 and stayed that way until 1837. It remains the only time that a major country was without debt. Jackson and his followers believed that freedom from debt was the linchpin in establishing a free republic.

1) Switzerland

Switzerland is a country that, in practically all economic and social metrics, is an example to follow. With a population of almost 9 million people, Switzerland has no natural resources of its own, no access to the sea, and virtually no public debt.

Zero/low national debt could impact you, the individual, because government spending may be cut or you may have to pay higher taxes. Without national debt, there'd be no US Treasury Bonds — debts backed by the “full faith and credit” of the US government — because the government borrows money by selling those bonds.

Key Takeaways. A budget deficit occurs when the money going out exceeds the money coming in for a given period. On this page, we calculate the deficit by the government's fiscal year. In the last 50 years, the federal government budget has run a surplus five times, most recently in 2001.

As of January 2023, the five countries owning the most US debt are Japan ($1.1 trillion), China ($859 billion), the United Kingdom ($668 billion), Belgium ($331 billion), and Luxembourg ($318 billion).

On January 8, 1835, President Andrew Jackson achieves his goal of entirely paying off the United States' national debt. It was the only time in U.S. history that the national debt stood at zero, and it precipitated one of the worst financial crises in American history.

Japan has the highest percentage of national debt in the world at 259.43% of its annual GDP.

Jerome Kerviel, The Most Indebted Person In The World, Owes $6.3 Billion To Former Employer, Societe Generale. In a hyper-competitive world where everyone strives to be the biggest, boldest and most famous, no one covets Jerome Kerviel record-breaking achievement. He is the most indebted person in the world.

At the top is Japan, whose national debt has remained above 100% of its GDP for two decades, reaching 255% in 2023.

Why can't the US pay their debt?

Tax cuts, stimulus programs, increased government spending, and decreased tax revenue caused by widespread unemployment generally account for sharp rises in the national debt.

Answer and Explanation: If everyone stopped getting in debt and paid off all their credit cards, saved for everything and spent what they earned this will increase the savings excessively which will decrease the circulation of money in the economy.

- Tax hikes alone are rarely enough to stimulate the economy and pay down debt.

- Governments often issue debt in the form of bonds to raise money.

- Spending cuts and tax hikes combined have helped lower the deficit.

- Bailouts and debt defaults have disadvantages but can help a government solve a debt problem.

Many people believe that much of the U.S. national debt is owed to foreign countries like China and Japan, but the truth is that most of it is owed to Social Security and pension funds right here in the U.S. This means that U.S. citizens own most of the national debt.

To balance the federal budget, government revenue must meet or exceed government spending. That's happened only twice in the past half-century: President Lyndon Johnson did it in 1969, and President Bill Clinton from 1998 to 2001. These days, the federal budget is far from balanced.

It's 22% higher than the U.S. gross national product as of June 30 (about $27 trillion). It's six times the U.S. debt figure in 2000 ($5.6 trillion). Paid back interest-free at the rate of $1 million an hour, $33 trillion would take more than 3,750 years.

Intragovernmental debt accounts for 26 percent or $5.9 trillion. The public includes foreign investors and foreign governments. These two groups account for 30 percent of the debt. Individual investors and banks represent 15 percent of the debt.

Japan owns the most at $1.1 trillion, followed by China, with $859 billion, and the United Kingdom at $668 billion. In isolation, this $7.4 trillion amount is a lot, said Scott Morris, a senior fellow at the Center for Global Development.

China is one of the United States's largest creditors, owning about $859.4 billion in U.S. debt.

According to the Congressional Budget Office, the United States last had a budget surplus during fiscal year 2001, though the national debt still increased.

Why was the US in debt in the beginning?

The Beginning of U.S. Debt

Paying for the American Revolutionary War (1775 - 1783) was the start of the country's debt. Some of the founding fathers formed a group and borrowed money from France and the Netherlands to pay for the war. To manage the new country's money, the Department of Finance was created in 1781.

Federal Borrowing

The federal government borrows money from the public by issuing securities—bills, notes, and bonds—through the Treasury. Treasury securities are attractive to investors because they are: Backed by the full faith and credit of the United States government.

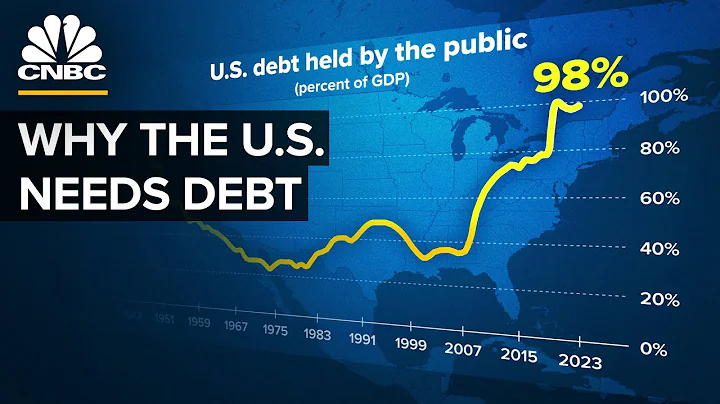

It began rising at a fast rate in the 1980's and was accelerated through events like the Iraq Wars and the 2008 Great Recession. Most recently, the debt made another big jump thanks to the pandemic with the federal government spending significantly more than it took in to keep the country running.

Russia National Government Debt reached 287.8 USD bn in Jan 2024, compared with 285.4 USD bn in the previous month. Russia National Government Debt data is updated monthly, available from May 2009 to Jan 2024. The data reached an all-time high of 384.2 USD bn in Jun 2022 and a record low of 86.1 USD bn in May 2009.

References

- https://www.creditninja.com/blog/can-you-have-a-700-credit-score-with-collections/

- https://fiscaldata.treasury.gov/americas-finance-guide/national-deficit/

- https://www.quora.com/Why-does-the-US-owe-so-much-debt-to-Japan

- https://apnews.com/article/japan-economy-2023-gdp-893d53deba654c4924e4924f0b321cc5

- https://en.wikipedia.org/wiki/History_of_the_United_States_public_debt

- https://www.imf.org/en/News/Articles/2024/02/08/mcs020824-japan-staff-concluding-statement-of-the-2024-article-iv-mission

- https://www.reuters.com/markets/asia/japan-cuts-spending-first-time-12-years-202425-budget-2023-12-22/

- https://www.credit.com/blog/does-your-old-debt-have-an-expiration-date/

- https://worldpopulationreview.com/country-rankings/countries-by-national-debt

- https://wallethub.com/answers/cs/how-to-remove-collections-from-credit-report-without-paying-2140646704/

- https://www.forbes.com/advisor/retirement/debt-ceiling-impact-social-security/

- https://www.moneylion.com/learn/debt-after-7-years/

- https://www.chase.com/personal/credit-cards/education/basics/average-credit-score-by-age

- https://www.highradius.com/resources/Blog/what-is-credit-dispute-letter-and-how-to-dispute-credit-report/

- https://www.lingualift.com/blog/japanese-national-debt/

- https://www.farmermorris.com/faqs/why-you-should-never-pay-collection-agency/

- https://www.usnews.com/news/best-countries/articles/the-top-10-economies-in-the-world

- https://www.youngmarrlaw.com/does-disputing-a-debt-restart-the-statute-of-limitations/

- https://usafacts.org/articles/which-countries-own-the-most-us-debt/

- https://homework.study.com/explanation/what-would-happen-if-everyone-stopped-getting-in-debt-and-paid-off-all-their-credit-cards-if-people-saved-for-everything-and-only-spent-what-they-earned.html

- https://www.credit.com/blog/what-is-609/

- https://www.creditkarma.com/advice/i/long-collections-credit-report

- https://www.ceicdata.com/en/indicator/russia/national-government-debt

- https://www.nolo.com/legal-encyclopedia/what-is-the-statute-limitations-credit-card-debt-california.html

- https://www.thebalancemoney.com/who-owns-the-u-s-national-debt-3306124

- https://www.marketplace.org/2023/05/26/who-does-the-u-s-owe-31-4-trillion/

- https://www.huffpost.com/entry/jerome-kerviel-most-debt-in-the-world_n_2077219

- https://finance.yahoo.com/news/15-states-best-economy-now-221840309.html

- http://fingfx.thomsonreuters.com/gfx/rngs/CHINA-DEBT-GRAPHIC/0100315H2LG/

- https://www.visualcapitalist.com/worlds-richest-countries-across-3-metrics/

- https://www.investopedia.com/articles/economics/11/successful-ways-government-reduces-debt.asp

- https://www.visualcapitalist.com/which-countries-hold-the-most-us-debt/

- https://www.cfr.org/backgrounder/us-national-debt-dilemma

- https://www.freedomdebtrelief.com/learn/credit-card-debt/what-happens-to-unpaid-credit-card-debt-after-7-years/

- https://loanscanada.ca/debt/why-did-an-account-in-collections-disappear-from-my-credit-report/

- https://finance.yahoo.com/news/happens-u-defaults-debt-143652479.html

- https://medium.com/pitfall/that-time-the-us-had-zero-national-debt-4ac350b553d9

- https://homework.study.com/explanation/what-would-happen-if-the-government-erased-all-debts-that-it-accrued.html

- https://www.quora.com/If-China-sells-all-US-treasury-bonds-what-will-happen-to-the-US-economy

- https://www.marketplace.org/2023/02/08/what-would-it-take-balance-federal-budget/

- https://www.investopedia.com/articles/investing/080615/china-owns-us-debt-how-much.asp

- https://www.forbesindia.com/article/explainers/top-10-largest-economies-in-the-world/86159/1

- https://oag.ca.gov/consumers/general/debt-collectors

- https://www.fcwlegal.com/bankruptcy/what-can-and-cannot-be-discharged-in-bankruptcy/

- https://teachinghistory.org/history-content/ask-a-historian/23559

- https://www.identityiq.com/credit-monitoring/what-happens-to-your-credit-after-7-years/

- https://www.statista.com/statistics/246420/major-foreign-holders-of-us-treasury-debt/

- https://www.pgpf.org/top-10-reasons-why-the-national-debt-matters

- https://www.stlouisfed.org/on-the-economy/2023/nov/what-lessons-drawn-japans-high-debt-gdp-ratio

- https://fiscaldata.treasury.gov/americas-finance-guide/national-debt/

- https://www.treasurydirect.gov/kids/history/history.htm

- http://www.cadtm.org/spip.php?page=imprimer&id_article=13550

- https://www.equifax.com/personal/education/credit/report/articles/-/learn/how-long-does-information-stay-on-credit-report/

- https://www.citizensadvice.org.uk/debt-and-money/help-with-debt/dealing-with-your-debts/check-if-you-have-to-pay-a-debt/

- https://finance.yahoo.com/news/us-national-debt-sits-33-123000638.html

- https://www.solosuit.com/posts/debt-sold-to-collection-agency

- https://www.history.com/this-day-in-history/andrew-jackson-national-debt-reaches-zero-dollars

- https://en.wikipedia.org/wiki/Financial_position_of_the_United_States

- https://www.bankrate.com/finance/credit-cards/credit-card-debt-sold-to-collector/

- https://www.cbsnews.com/minnesota/news/good-question-how-did-the-u-s-debt-get-so-high/

- https://www.investopedia.com/financial-edge/0911/7-things-you-didnt-know-about-sovereign-debt-defaults.aspx

- https://www.quora.com/How-much-does-Mexico-owe-the-United-States

- https://www.treasurydirect.gov/government/historical-debt-outstanding/

- https://apnews.com/article/poverty-japan-children-mothers-filmmaking-unmarried-2391ebf0bd955795195fbad25dd13348

- https://www.consumerfinance.gov/ask-cfpb/should-i-share-personal-information-with-a-debt-collector-en-2098/

- https://www.imf.org/en/Blogs/Articles/2023/09/13/global-debt-is-returning-to-its-rising-trend

- https://www.farmermorris.com/faqs/11-word-phrase-to-stop-debt-collectors/

- https://finance.yahoo.com/news/top-20-countries-owe-us-175515001.html

- https://www.quora.com/How-much-does-America-owe-to-other-countries-and-how-much-do-those-countries-owe-America

- https://www.clearfinances.net/countries-without-public-debt/

- https://www.visualcapitalist.com/government-debt-by-country-advanced-economies/

- https://en.wikipedia.org/wiki/Debt_relief

- https://www.itsuptous.org/blog/who-does-us-owe-money-to

- https://history.state.gov/milestones/1945-1952/japan-reconstruction

- https://people.howstuffworks.com/5-united-states-debt-holders.htm

- https://www.consumerfinance.gov/ask-cfpb/can-debt-collectors-collect-a-debt-thats-several-years-old-en-1423/

- https://www.gao.gov/americas-fiscal-future/federal-debt

- https://budgetmodel.wharton.upenn.edu/issues/2023/10/6/when-does-federal-debt-reach-unsustainable-levels