What are the steps in processing payments for online transactions?

The process

- Customer. The customer initiates the payment by selecting the desired product or service on the business's website and entering their payment details.

- Business. ...

- Payment gateway. ...

- Payment processor. ...

- Issuing bank or card network. ...

- Payment processor. ...

- Payment gateway. ...

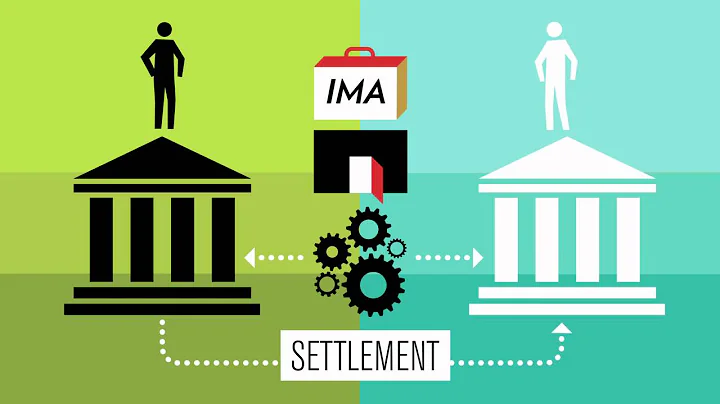

- Settlement and funding.

Using secure communication methods and tokenization, payment gateways communicate between your online store/website and your bank. Customer data is collected, validated, approved, and then the payment is accepted, debiting your customer's account.

There are three stages to payment processing: validation, reservation, and finalization. The payment life cycle is related to the order life cycle stages: order capture, release to fulfillment, and shipping. Ensures that a customer has adequate funds to make the purchase.

The customer authorises payment via an online form allowing the business to automatically collect the funds when due. The business' bank and the customer's bank communicate and action the payment request when the payment is due, ensuring the correct amount is debited from the customer and credited to the business.

Online payment systems are a way of facilitating payments for goods and services online. These systems consist of three parts – the payment gateway, the payment processor, and the merchant account – which between them handle the entire transaction.

Transaction processing systems generally go through a five-stage cycle of 1) Data entry activities 2) Transaction processing activities 3) File and database processing 4) Document and report generation 5) Inquiry processing activities.

There are six steps in processing a transaction. They are data entry, data validation, data pro- cessing and revalidation, storage, - output generation, and query support.

Merchants send batches of authorized transactions to their payment processor. The payment processor passes transaction details to the card associations that communicate the appropriate debits with the issuing banks in their network. The issuing bank charges the cardholder's account for the amount of the transactions.

In general, your customers' online payments should clear within 1 to 3 days. The exact processing times can vary depending on the card issuer. For new and inexperienced merchants, this delay can be a point of concern.

Which method is popular for online transaction?

Credit and debit cards are the most common payment methods for ecommerce transactions. They allow customers to make payments quickly and conveniently. Digital wallets, such as PayPal, Apple Pay, and Google Pay, have become increasingly popular.

It includes services like authorization, funding, and settling of a transaction. When a customer makes a purchase, the payment is made with the card at the point of sale, popularly known as POS. Though the transaction takes a second, the process behind the trade is intricate.

- Step 1: Identify your transactions.

- Step 2: Record the transactions.

- Step 3: Post transactions to the general ledger.

- Step 4: Create the trial balance.

- Step 5: Analyze the worksheet.

- Step 6: Adjust journal entries.

- Step 7: Create financial statements.

- Step 8: Close the books.

Practically, a TPS gathers, stores, alters, and retrieves data transactions in a business. Transaction Processing Systems are characterized by their rapid processing of data, reliability, use of standard procedures, and control access.

The first step in the transaction processing cycle is data entry.

Different examples of transaction processing include automated teller machines, credit card authorizations, online bill payments, self-checkout stations at grocery stores, the trading of stocks over the Internet, and various other forms of electronic commerce.

- the expenditure cycle,

- the conversion cycle, and.

- the revenue cycle.

The movement that money makes when exchanged for a product or service is what we call transaction. Thus, payment is only one step in a process that involves an intense flow of information exchange between several parties: gateways, sub-acquirers and/or acquirers, brands and issuing banks.

The issuing bank transfers the funds to the credit card association. The credit card association passes the funds on to the acquiring bank. The acquiring bank deposits the funds in the seller's account. The issuing bank deducts the funds from the customer's account and closes the transaction.

Transaction processing is a type of computer processing that indicates the bank needs to immediately respond to a customer's request. Each request is considered a transaction. A good example of transaction processing in a bank is automatic teller machines.

Why do online payments take so long to process?

Some banks may take longer than others to process and clear any funds they receive. This happens due to outdated infrastructure, banking restrictions or closures. Many banks tend to process payments in 48-72hr backdated batches. Therefore, debited funds show as pending, despite clearing with a merchant or recipient.

A pending deposit to a bank account may be declined if the account the deposit comes from lacks sufficient funds. A pending check deposit to a bank account could be declined if the check was filled out incorrectly, is fraudulent, is over six months old or has a stop payment.

In general, it can take up to three business days for a pending transaction to clear. But that time frame can depend on the bank or credit card issuer, the payment network—like the Automated Clearing House (ACH)—and the type of transaction.

- Pay What You Can. This option will allow the client to choose if they can pay or not, and how much. ...

- Sliding Scale. Another way to provide clients the flexibility to pay what they can afford is to offer a sliding scale. ...

- Payment Plan. ...

- Larger Deposit. ...

- Time-Sensitive Offer.

The payment gateway converts the message from XML to ISO 8583 or a variant message format (format understood by EFT Switches) and then forwards the transaction information to the payment processor used by the merchant's acquiring bank.

References

- https://www.cusocal.org/blog/is-it-safe-to-use-a-debit-card-online

- https://www.inc.com/encyclopedia/transaction-processing.html

- https://creditcardgenius.ca/blog/how-to-pay-off-credit-card

- https://stripe.com/resources/more/ecommerce-payment-methods

- https://www.paypal.com/us/webapps/mpp/paypal-safety-and-security

- https://segmentify.com/blog/best-payment-methods-for-ecommerce/

- https://pay.com/blog/4-methods-of-payments-accepted-in-us

- https://gocardless.com/guides/posts/how-to-create-online-payment-system/

- https://www.versapay.com/resources/most-least-secure-b2b-payment-methods

- https://www.yesbank.in/blogs/credit-card/the-main-purpose-of-the-cvv-number-on-a-credit-card

- https://www.pomelopay.com/blog/most-secure-payment-method

- https://www.capitalone.com/learn-grow/money-management/pending-transactions/

- https://staxpayments.com/blog/accepting-payments-online/

- https://www.forbes.com/advisor/in/banking/payment-banks-in-india/

- https://payu.in/blog/how-do-online-payments-work-in-india/

- https://lifehacker.com/safest-payment-methods-1850934063

- https://brainly.in/question/2675013

- https://noda.live/articles/top-secure-payment-methods

- https://www.avast.com/c-how-to-avoid-venmo-scams

- https://3s.money/help-centre/sending-and-receiving-payments/why-is-my-payment-taking-so-long

- https://gocardless.com/guides/posts/how-do-instant-payments-work/

- https://www.paypal.com/us/webapps/mpp/paypal-fees

- https://www.canada.ca/en/financial-consumer-agency/services/credit-cards/pay-off-credit-card.html

- https://360payments.com/asking-for-identification-for-a-credit-card-sale-should-you-do-it/

- https://www.fisglobal.com/en/insights/merchant-solutions-worldpay/article/how-credit-card-processing-works

- https://study.com/academy/lesson/transaction-processing-systems-tps-manual-and-automated-systems.html

- https://www.toppr.com/ask/question/the-very-first-step-in-online-transaction-is/

- https://www.rba.gov.au/payments-and-infrastructure/payments-system.html

- https://www.vedantu.com/commerce/online-transactions

- https://wise.com/us/blog/how-to-send-money-to-someone-without-a-bank-account

- https://www.transfergo.com/send-money-debit-credit-card

- https://corporatefinanceinstitute.com/resources/career-map/sell-side/capital-markets/online-payment-companies/

- https://www.fiscal.treasury.gov/ach/

- https://www.adyen.com/knowledge-hub/online-payment-methods

- https://support.google.com/googleplay/answer/4646404?hl=en&co=GENIE.Platform%3DAndroid

- https://www.businessofapps.com/data/mobile-payments-app-market/

- https://paysimple.com/blog/online-payments-5-steps-to-get-started/

- https://www.probytes.net/blog/how-to-add-payment-method-on-website

- https://www.cnet.com/personal-finance/banking/advice/best-digital-wallets-payment-apps/

- https://www.moneyhelper.org.uk/en/everyday-money/banking/debit-cards

- https://gocardless.com/guides/posts/safe-payment-methods-online/

- https://www.andrews.edu/~geddes/AIS_Textbook/ch02.ppt

- https://paysimple.com/blog/all-the-ways-you-can-accept-online-payments-in-2022/

- https://www.atg.wa.gov/debit-cards

- https://upstox.com/banking/rtgs-fastest-mode-of-transfer/

- https://www.nerdwallet.com/article/small-business/how-to-accept-credit-card-payments

- https://papers.ssrn.com/sol3/Delivery.cfm/SSRN_ID1529303_code709775.pdf?abstractid=1529303&mirid=1

- https://www.toppr.com/guides/business-studies/emerging-modes-of-business/online-transactions-and-security-of-e-transactions/

- https://stripe.com/resources/more/payment-processing-explained

- https://paytm.com/blog/debit-card/what-is-cvv-in-a-debit-card/

- https://www.zellepay.com/security

- https://www.goodreturns.in/payment-apps-and-e-wallets.html

- https://www.paypal-community.com/t5/Archive/Will-Paypal-take-money-from-my-bank-without-permissions-or/td-p/491186

- https://support.creditkarma.com/s/article/How-to-verify-your-identity-US

- https://gocardless.com/guides/posts/basics-online-payment-processing/

- https://indstuds.yolasite.com/resources/08.tps.pdf

- https://www.hdfcbank.com/personal/resources/learning-centre/pay/how-to-pay-with-a-credit-card

- https://www.hdfcbank.com/personal/resources/learning-centre/pay/what-is-credit-card-how-do-credit-cards-work

- https://www.paypal.com/us/brc/article/how-to-set-up-online-payment-processing

- https://www.legalzoom.com/articles/how-to-pay-yourself-from-your-small-business

- https://www.about-payments.com/e-commerce-markets/which-online-payment-methods-to-accept-in-united-states-of-america

- https://www.quora.com/Why-cant-I-use-any-debit-card-for-online-purchases

- https://gocardless.com/en-us/guides/posts/secure-payment-methods/

- https://startups.co.uk/payment-processing/how-to-take-card-payments/

- https://www.britannica.com/money/online-banking-safety-tips

- https://www.ngpf.org/blog/question-of-the-day/question-of-the-day-what-is-the-1-contactless-mobile-wallet-payment-method/

- https://www.gettrx.com/payment-processing-basics/

- https://paysimple.com/blog/how-to-set-up-an-online-payment-form/

- https://help.hcltechsw.com/commerce/7.0.0/com.ibm.commerce.payments.events.doc/concepts/cppedpglass.html

- https://www.nttdatapay.com/blog/advantages-and-disadvantages-of-online-payments/

- https://www.investopedia.com/articles/markets/101415/4-best-alternatives-paypal.asp

- https://quickbooks.intuit.com/r/bookkeeping/accounting-cycle/

- https://unicorngroup.ch/blog/how-long-does-online-credit-card-payment-processing-take/

- https://razorpay.com/blog/different-types-of-payment-methods/

- https://ecommpay.com/products/payment-methods/payment-systems-in-north-america/

- https://gocardless.com/en-us/guides/posts/top-6-list-of-alternative-payment-methods/

- https://www.hdfcbank.com/personal/resources/learning-centre/pay/is-debit-card-compulsory-for-upi

- https://www.bankbazaar.com/credit-card/guide-to-credit-card-transactions.html

- https://www.chase.com/personal/credit-cards/education/basics/why-do-some-sites-not-require-cvv

- https://byjus.com/question-answer/the-first-step-in-the-transaction-processing-cycle-is-data-entryuse-inquirydatabase-operationsauditnone-of-these/

- https://squareup.com/au/en/the-bottom-line/operating-your-business/most-secure-payment-methods

- https://www.geeksforgeeks.org/electronic-payment-system-types-advantages-disadvantages-and-regulatory-bodies/

- https://www.experian.com/blogs/ask-experian/what-is-pending-transaction/

- https://paysimple.com/blog/small-business-payment-options/

- https://brainly.com/question/41542817

- https://gocardless.com/guides/posts/6-best-payment-methods-for-small-businesses/

- https://theconversation.com/how-risky-is-it-to-give-card-details-over-the-phone-and-how-do-i-reduce-the-chance-of-fraud-216833

- https://sell.amazon.in/seller-blog/different-types-of-e-commerce-payment-systems

- https://practicebetter.io/5-ways-to-structure-payments-for-clients/

- https://nordvpn.com/blog/safest-way-to-pay-online/

- https://www.profit.co/blog/industries/banking/improving-transaction-processing-support/

- https://stripe.com/resources/more/accept-credit-and-debit-card-payments

- https://ebizcharge.com/blog/how-to-set-up-credit-card-processing-for-small-businesses/

- https://gocardless.com/en-us/guides/posts/how-to-create-online-payment-system/

- https://www.statista.com/statistics/895236/australia-market-share-online-payment-platforms/

- https://www.verifi.com/chargebacks-disputes-faq/how-do-online-payments-work/

- https://www.kevin.eu/blog/history-of-online-payments/

- https://gocardless.com/guides/online-payments-guide/online-payments-introduction/

- https://www.zuko.io/blog/asking-for-credit-card-information-in-online-forms

- https://www.moneygram.com/walmart/us/en/send/how-to-send-money/send-to-a-debit-card

- https://www.webfx.com/blog/web-design/online-payment-systems/

- https://www.linkedin.com/pulse/top-10-most-used-payment-app-world-anup-sharma-ulobc

- https://en.wikipedia.org/wiki/List_of_online_payment_service_providers

- https://www.mineraltree.com/blog/electronic-payments-what-your-business-needs-to-know/

- https://www.thebalancemoney.com/calculate-credit-card-payments-and-costs-315644

- https://www.sunnyavenue.co.uk/insight/can-i-have-a-card-machine-without-a-business-account

- https://www.experian.com/blogs/ask-experian/what-happens-after-i-apply-for-a-credit-card/

- https://gocardless.com/guides/posts/how-to-create-a-payment-gateway/

- https://www.nerdwallet.com/best/small-business/payment-gateways

- https://help.vtex.com/tutorial/what-is-a-transaction--36vMP5PES4oUWMWQuskIQ6

- https://www.csus.edu/indiv/t/tsain/m219/m219-amor13.ppt

- https://pay.com/blog/payment-processing-work

- https://www.pinelabs.com/blog/online-payments-and-its-types-methods-and-meaning

- https://www.hdfcbank.com/personal/resources/learning-centre/pay/how-to-use-debit-cards

- https://wise.com/us/blog/send-money-with-debit-card

- https://www.chase.com/personal/credit-cards/education/basics/how-to-calculate-your-minimum-credit-card-payment

- https://stripe.com/resources/more/online-payment-processing-101

- https://www.freshbooks.com/hub/payments/what-is-electronic-payment

- https://tipalti.com/mass-payments-hub/global-payment-methods/

- https://en.wikipedia.org/wiki/Payment_gateway